How a GPS Can Make This Year Your Best One Yet

It was a few days before the New Year in 2011. I sat at my desk staring at my computer in embarrassment. I was looking at my account balances and to my sheer horror, there was no money in my account.

I’m not sure why I was mortified by this discovery.

I knew there was no money in my account. It’s like opening your fridge for the millionth time even though you know you haven’t gone grocery shopping in weeks. Duh!

I realized I couldn’t answer the question “where does my money go? It didn’t make sense (to me) that I was working, getting paid (granted it wasn’t much), yet it seemed like I was living paycheck to paycheck.

I understood that I needed to save my money.

The real question was: “Why didn’t it translate into action?”

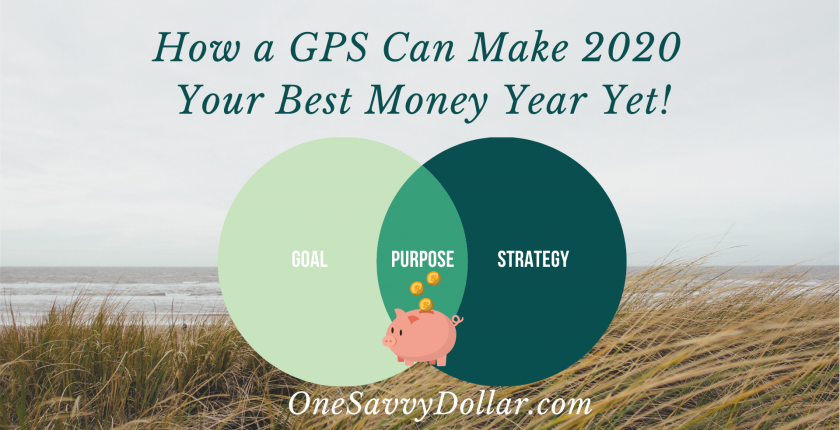

What Is A GPS (Goals. Purpose. Strategy)?

So one thing most people don’t know about me is that I’m directionally challenged. Before the GPS, I was the girl who used to read Mapquest………..while driving. *facepalm*

{If you don’t know what MaqQuest is, we need to have a separate conversation}.

When giving me directions, the last thing you want to say is; “head southwest”. Sir/Ma’am, I’m sorry but the only southwest I know is the airline.

My personal favorite: “Drive 3 miles and then make a right.” Listen, you could have simply said, “Drive for 3 Rihanna songs and then make a right” – anything other than that makes zero sense.

The GPS as we have it today with voice and signals was made specifically for me. The real reason why you can’t seem to save your money is because you have no GPS.

By GPS, I mean a goal, purpose, and strategy.

Goals:

Your goal is simply stating what you want. I like to call goals a declaration. Think of it as an announcement to yourself – and to others if you share them.

Back to my story.

Do you think everything started off perfect?

Noooooo, it didn’t!

I would transfer some money from my checking to my savings account and shortly after, dip right into it for some stuff I probably no longer have.

All my spending seemed to be an emergency; there were no clear boundaries. I would take one step forward and then take three or more steps back the next month.

This back and forth continued where I was still at little to no savings in my account until I decided on a specific goal amount to save for the rest of the year.

Suddenly, trying to saving didn’t seem so difficult.

Purpose:

Sure setting your goals by declaring what you want is good. Do you know what’s better? Creating your why.

I was now saving; still dipping into my savings occasionally, but not as much as before I set my goal.

Here’s what I realized: it was easy to get distracted from my goal because I had no purpose. Having no purpose for my saving meant I had nothing to look forward to.

After declaring the intention to save, I never identified my why.

Why was it important for me to save?

My lack of purpose made it difficult to say no to spending that took away from my money’s purpose bcause my money had no purpose attached to it.

Your why has to be something you really really really desire, so that you’re more willing to give up anything that gets in the way of achieving your money’s goal.

Purpose gives you direction; keeps you disciplined, and helps you stay motivated because you now have an endgame.

For me, I wanted to save so I could invest and take advantage of wealth-building opportunities and eventually live life on my own terms.

Saving my money was the first step.

Strategy:

A what and a why without a how wouldn’t help you accomplish your goals either. If your why keeps you disciplined, your how holds you accountable because you now have a system/structure.

I was clear on my “what” and “why” but the big question was how?

How was I going to accomplish my goal of saving and sticking with it? I listed all my hows.

- I decided to stop shopping mindlessly.

- Deleted apps that encouraged mindless spending with sale offers.

- I promised to pay myself first immediately I got paid – not a moment later.

- I also created a completely separate account without a card to make my transfer easier and avoid dipping.

Your ability to save is not only tied to your income but to your habit(s).

What bad money habits are you willing to let go of in order to increase your chances of reaching your financial goals?

Stop brunchin’ every weekend so you can start saving for the future? Maybe going cold turkey is too much for you. Can you reduce brunch to 3 times instead of 9 times in a month?

Anytime, I didn’t transfer the expected amount into my saving, I simply went through my list of hows to find out which strategy I failed to implement. My how ensured I remained accountable to myself.

It all sounds like a lot but the more you practice, the easier it becomes.

I have taken saving for my future self seriously and never looked back since applying the GPS model to my life.

I was able to pay off the balance of my student loan ($20,000) in one lump sum and purchase a car for $7,000 in cash at the same time.

Your Goal, Purpose, and Strategy For 2021

To get you started with starting AND sticking with your saving goals for 2020, I‘ve created a 52 weeks saving schedule for you with a goal amount so you don’t overthink yourself to a standstill.

You can pick up a copy of the 52 Weeks Saving Challenge schedule in our library. There are three biweekly schedules for 2021; $7,000, $10,000, and $14,000. Whatever purpose you’re saving for, this saving schedule can help you accomplish that.

“The habit of saving is itself an education. It fosters every virtue, teaches, self-denial, cultivates the sense of order, trains to forethought and so broadens the mind” Thornton T. Munger.