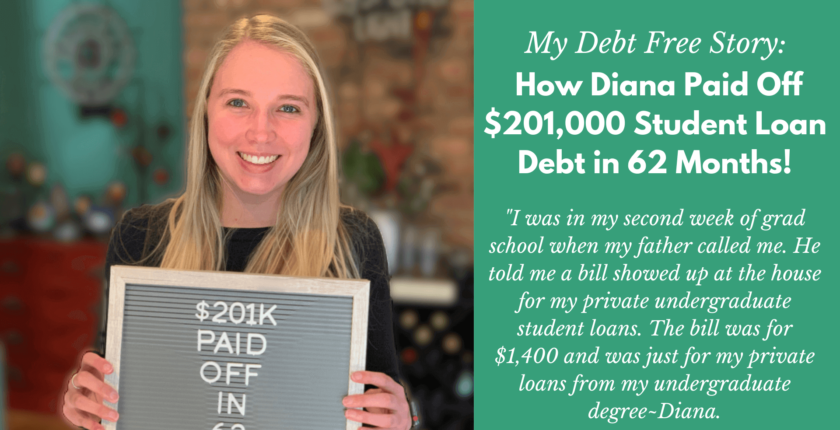

My Debt Free Story: How Diana Paid Off $201,000 Debt in 62 Months

Last updated on September 20th, 2023 at 03:52 am

My debt free story is a OneSavvyScholar series where we interview people who have successfully paid off any major debt i.e. student loans, car loans, credit cards etc.

The aim is to inspire, encourage, and motivate you to take hold of your personal finance because “financial fitness is not a pipe dream or a state of mind. It is a reality if you’re willing to pursue it and embrace it.” – Will Robinson

Can you tell us a bit about you?

I graduated in 2014 with a bachelor’s in inclusive elementary and special education and roughly $180,000 in debt, which I didn’t know at the time of graduation.

One week after graduation, I began my master’s degree in literacy education to become a reading specialist and graduated in August of 2015 with $201,000 in student loan debt.

I moved back home to my parent’s house in New Jersey and began teaching 5th grade that fall and stayed in the public school system teaching for 4 years.

In 2019, I accepted a new position at a private school as the building reading specialist and have been there ever since. I am a bit of a workaholic and love to increase my income through side hustles.

What and when was your “sick and tired” of debt moment?

In June 2014, I was in my second week of grad school when my father called me. He told me a bill showed up at the house for my private undergraduate student loans.

The bill was for $1,400 and was just for my private loans from my undergraduate degree and there I was just beginning my master’s degree and taking out more student loans.

This sent me into a complete panic because I knew this would be only a portion of my monthly payments post grade and I knew my income as a teacher wouldn’t support this.

I completely shifted my plans that day. I made a meeting with my grad school advisor and we walked through everything and even made a plan for me post-grad.

How did you acquire the debt and do you regret doing so?

My debt is all from my bachelor’s and master’s degrees in the form of student loans. I don’t regret it, but if I could do it again I would definitely do it differently.

I would have made sure I was more aware of the debt I was accumulating and doing what I could to lower it.

How much debt did you pay off in total? How much money in interest and time did you save in total?

I paid off $201,000 in student loan debt. I had mostly private student loan debt, roughly $150k, and the rest were federal student loans.

I started focusing on paying off my debt seriously in November 2015 at $201,000 and finished in December 2020. I haven’t calculated the interest I saved, but I know I would have been on a 20-year plan, so I paid them back roughly 15 years early!

How much income were you earning when you accomplished this?

Over the course of the 5 years, I was earning between $56,000 and $65,000.

Can you describe the specific choices you had to make to become debt-free?

The biggest choice I made was moving back home. When I first made this choice, it was required due to my payments. I simply couldn’t afford my payments and cost of living.

My parents lived in a high cost of living area, so my starting salary was a bit higher compared to other parts of the country for teachers, too. Then, I stayed living there even when I could have moved out.

I was fortunate that my parents didn’t require me to pay rent as long as I was working towards paying off my student loans. Also, I became very intentional with where I spent my money. I worked through my spending and made decisions about where I value my money to go.

This allowed me to still enjoy my life while I was reaching my goals. Finally, I worked a lot. I took any and all opportunities offered at school, before school programs, after school programs, or extra coverages. I also tutored, babysat, freelanced, and did VIPKID to make extra money.

Was there any time during your journey where your friends and or family challenged your plans to become debt free?

Absolutely. This is not the normal thing to do in our society. I had a lot of people in my life question what I was doing. This was challenging, but I knew why I was doing it.

It wasn’t simply to be debt-free, it was to be able to live my life on my terms for the rest of my life and experience financial independence. When I would talk about this aspect of becoming debt free, most people understood why I was paying off my debt

Were any resources such as blogs, books, podcasts particularly helpful to you in staying on track with your debt free journey?

When I first began, I remember simply Googling and finding Dave Ramsey and his baby steps. For someone who was at their absolute breaking point, it was something easy to follow.

As I got more interested in my personal finances, I read so many blogs and books to get more and more answers. I absolutely loved reading Broke Millennial by Erin Lowry and following people on Instagram doing similar things as me.

Over the years, the communities I have found through Instagram and Facebook have been encouraging and so helpful when needing advice.

How did you feel when you made that final payment?

Relief and excitement. This was such a massive burden I have been carrying for so many years and it feels amazing to no longer have this.

This debt has made me live my life in a very specific way the last 5 years and I am so excited to begin this next part of my journey without it.

What steps are you taking to ensure that you stay debt-free now?

I am making sure I continue to remember my long-term goals and continue to reach for the big ones. I will be starting my real estate investing journey in 2021 to purchase a duplex in order to house hack it.

I plan to rent the other side out, and maybe some rooms on the side I’m living in, to greatly decrease my housing expenses. This does mean I will be taking out mortgages on investment properties in the future, but they will be used as rentals

If you could go back in time and advise your 18-year-old self, what advice would you give her?

Don’t blindly follow the advice given to you about student loans and affording college.

I got into my student loan mess because I blindly took out the debt without truly understanding what student loans are and how to make college more affordable.

Based on my experience, I make sure to always do my own research about anything I am thinking about doing. It is so important to be knowledgeable about what we are doing and make informed decisions.

I wish I had done this while taking out my student loans while in college.

What advice would you give anyone who has debt and seeking encouragement?

Create a plan, determine the order that you will pay them off in, and then only focus on the debt you’re paying off. When you keep looking at the entire debt it can be extremely disheartening.

I struggled a lot with motivation in the beginning because I felt like I wasn’t making any traction in my overall progress. I was focusing so much on the entire debt total and not looking at the one loan I was focusing on.

When I started to just look at the difference in the account I was focusing on, my motivation increased so much. It was easier to think about paying off the smaller amount than the $201k I had in total.

I stopped tracking my progress on my total debt and only tracked it on the loan I was focused on paying off.

How can our readers keep in touch with you?

I spend most of my time on Instagram dianaonadime

______________________________________________________

Congratulations, Diana! Here’s wishing you much success on your financial journey. Would you like to graduate (almost) student loan debt free? You can start here.

Diana, you know we all are so proud of you and how you have plowed through your loan debt!! You will be a real asset to others contemplating school loans!!

Thank you for reading, Jenny. Her student loan debt-free story is amazing and inspiring.